June 12, 2024

5 Ways for Apple Employees to Avoid Owing Big on Tax

Take proactive steps to help reduce tax exposure from earned compensation. Download our comp strategies guide to help minimize year-end taxes.

Read More

For some Apple employees, it can be a baffling yearly experience to find more taxes are owed than expected.

Often, the question is left unanswered as to why this occurs annually. The answer is usually quite simple – RSU withholdings.

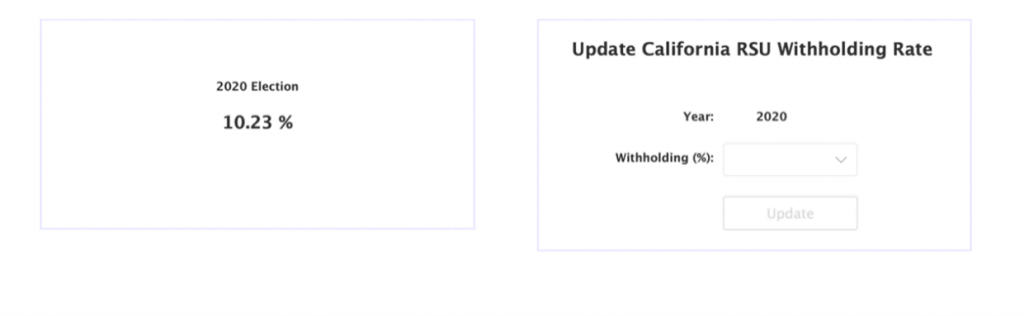

By default, Apple withholds 22% for Federal taxes and 10.23% for CA taxes.

*Note: Above Data is from 2020

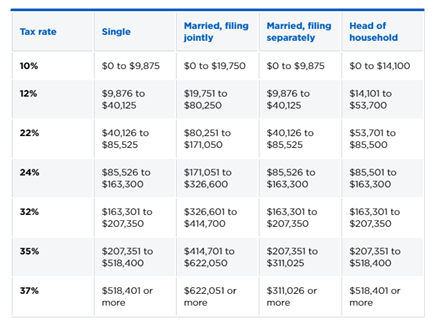

These rates are typically not enough. The 22% bracket for a married joint filer is $80,251 – $171,050*. Some Apple employees earn this much in RSU income alone.

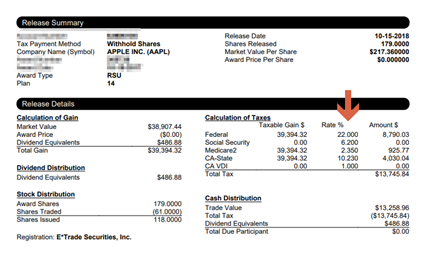

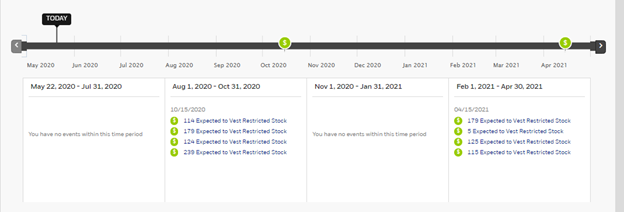

RSUs are only taxed on the date of vesting. The date of grant is not a taxable event. Because of the overlap of grants over time, the RSU income can start to pile up, especially after 4 years. To watch a video explanation of this, please go here.

To determine how much to withhold from your RSUs, follow these steps.

*Note: Above Data is from 2020

For further clarification, an example is provided below:

This is a hypothetical example meant for illustrative purposes only.

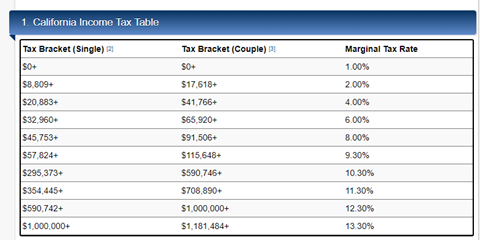

Placing $524K on the tax tables above demonstrates that a more appropriate tax withholding % should be 35% Federal and 12% state, not 22% Federal and 10.23% State.

Following the above steps provide a more consistent tax situation. However, there are circumstances where less or more withholdings are needed. As Wealth Advisors, we look at each client’s situation independently to determine the wisest approach. Should you have questions about your RSUs or how to maximize your financial relationship with Apple, please don’t hesitate to schedule a complimentary Zoom call by clicking here.