June 12, 2024

5 Ways for Apple Employees to Avoid Owing Big on Tax

Take proactive steps to help reduce tax exposure from earned compensation. Download our comp strategies guide to help minimize year-end taxes.

Read More

Apple stock can trade in a wide range throughout a calendar year. There are occasions when AAPL increases or decreases in value quickly. Selling AAPL after it has risen substantially is the goal for many Apple employees. However, if an employee is subject to blackout, they can miss out on an opportunity to sell AAPL. Read on to learn how a 10b5-1 plan can alleviate this predicament.

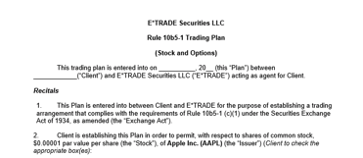

A 10b5-1 plan is a document between 3 parties – an employee, Apple and E*TRADE. The document outlines the time or price for when AAPL stock can be sold.

Because this document is created in advance of an open trading window, trades can occur at any point throughout the year, and remain active while the employee is blacked out.

Employees are placed on a black out list in order to protect the employee and the firm. Specific employees are subject to black-out because they know, or have access to, material non-public information. Because of this knowledge, Apple restricts these employee trading windows to only occur for approximately 30 days after each quarterly earnings release. Employees who trade based upon their material, non-public information are at risk of violating insider trading laws.

A 10b5-1 plan is required to be established during an open trading window, the plan specifies specific shares to be sold and at what price.

Because a 10b5-1 plan is created many weeks in advance of new information, sales can occur at any point in the future.

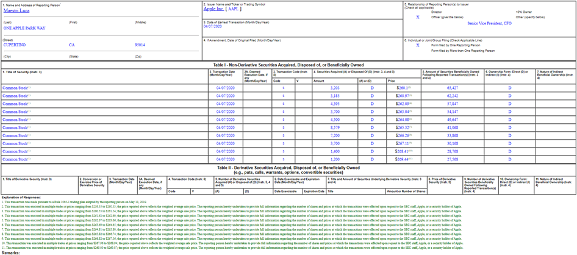

Any employee can have a 10b5-1 plan. Executives and managers are most likely to have a 10b5-1 plan in order to reduce insider trading risks related to AAPL stock. Below is an image from the SEC website showing sales that occurred for Luca Maestri as part of his 10b5-1 plan.

While most employees don’t have the same legal risk that Luca has, it can still make sense to have a 10b5-1 plan. A few additional reasons are as follows:

A 10b5-1 plan can be entirely set up through etrade.com. Follow the below steps to initiate the process.

There are some employees who are not allowed to complete a 10b5-1 plan online, those folks must complete their plan via paper after Apple approves their request.

Assigning shares of AAPL into a 10b5-1 plan is a decision that needs to be taken seriously. It can be difficult deciding how many shares to enroll in the plan, at what price to sell and for how long. As fiduciaries, the advice we provide clients is specific to their situation and needs. Please feel free to give us a call if you want to discuss a 10b5-1 plan and if it makes sense for you.