June 12, 2024

5 Ways for Apple Employees to Avoid Owing Big on Tax

Take proactive steps to help reduce tax exposure from earned compensation. Download our comp strategies guide to help minimize year-end taxes.

Read More

One of the largest benefits Apple provides employees is the ability to purchase stock through the Employee Stock Purchase Plan (ESPP). Unfortunately, most employees do not maximize this benefit to its fullest potential.

Over the course of this article, we will describe why we believe this benefit is lucrative, why you should consider contributing and the risk associated with the plan.. Let’s get started by explaining the basics of the ESPP and why it is advantageous.

Employee Stock Purchase Plans are not unique to Apple. They are quite common, particularly in Silicon Valley. ESPPs provide an employee the opportunity to purchase company stock at a discount to the fair market value. The discount that Apple provides is 15%.

This discount alone is a reason to consider maximizing contributions in the plan. However, Apple not only provides a 15% discount but also a 6-month look back feature. The 6-month period is known as the “offering period”. Below, we explain the offering period and how this benefit makes the ESPP so worthwhile.

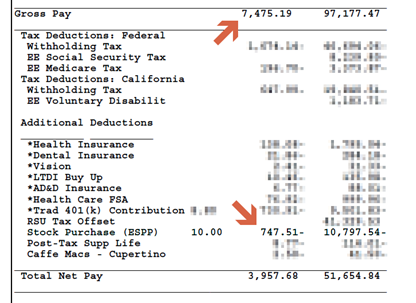

During the offering period, money is deducted from an employee’s paycheck and held in an escrow account.

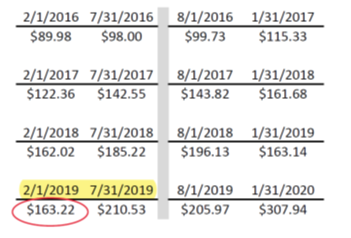

Every year, there are two offering periods, which are 2/1 – 7/31 and 8/1 – 1/31. At the end of each offering period, AAPL stock is purchased. The price of the purchase is the value of AAPL at either the beginning of the period OR the end, whichever is lower. Then, the 15% discount is applied. Below is a history since 2016 of AAPL stock during the ESPP lookback periods.

For a specific example, look at the 2/1/2019 – 7/31/2019 time period.

Because $163.22 is lower than $210.53, shares are received 15% below the $163.22 share price or at a price of $138.73.

Shares are purchased on 7/31/2019 for the employee at a price of $138.73. However, the actual price of the stock on 7/31/2019 is $210.53.

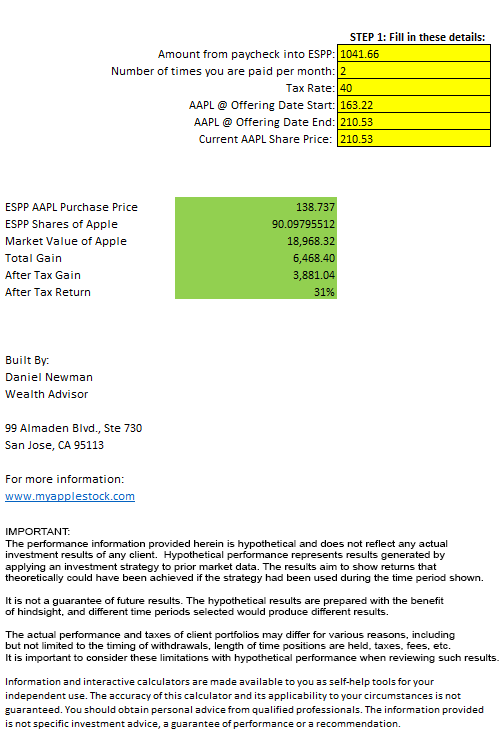

Assuming the shares are sold immediately, this amounts to a pre-tax gain of 52%. See below a snapshot of a spreadsheet we’ve created for Apple employees illustrating this point.

While this scenario is uncommon, it is important to note that even if the stock has declined during the 6-month period, there is always a minimum 15% gain if the stock is sold immediately.

It is our opinion that nearly everyone should consider participating in the ESPP.

The maximum allowable contribution per year is 10% of gross income. The gross income figure does not include annual bonuses or RSU vesting.

We believe that, if possible, the maximum contribution (10% of gross pay) should be made by every Apple employee. The key to remember, is that at the end of the 6-month period, ESPP shares can be sold with a minimum 15% gain if the stock is sold at the immediately, not factoring in any taxes. It is also very important to understand that if you cannot or don’t sell immediately, as with any stock the value of the stock can drop very quickly could go to zero. As with any benefit you must understand your risk of loss and this is especially important to remember when it comes to investing in your employer’s stock. Also having a large portion of your nest egg tied to the performance of one firm can create undue risk without proper planning so please consult with a professional prior to making any investment related decisions.

Within our role as Financial Advisors to our Apple clients, is providing advice on how much to contribute to the ESPP, when to sell, at what tax lots, etc. Should you have a question about your ESPP at Apple or any other financially related issue, feel free to schedule a complimentary consultation by clicking here.

For video explanations of the above concepts, please see these videos.

Get to know us and how we can help. Contact our team for a risk-free, comprehensive review of your finances.

SCHEDULE A MEETING