June 12, 2024

5 Ways for Apple Employees to Avoid Owing Big on Tax

Take proactive steps to help reduce tax exposure from earned compensation. Download our comp strategies guide to help minimize year-end taxes.

Read More

There are many monetary benefits available through Apple that can make a considerable impact on the long-term financial wellbeing of their employees. Two benefits of particular note are the 401(K) match and the ESPP program. In this article, we will illustrate how an Apple employee can obtain an additional $170,100 over a 10-year timeframe by simply maxing out the ESPP and 401(K) contributions.

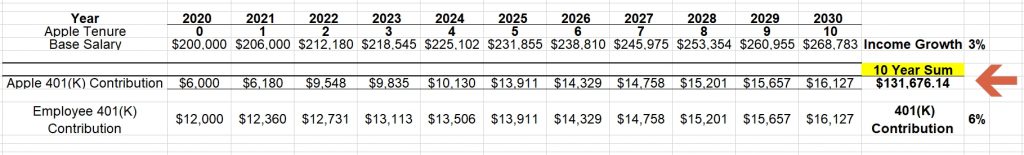

Below is a table illustrating the free money* available through Apple’s 401(K) matching plan.

The assumptions of the table are:

After 10 years, an Apple employee would receive $131,676.14 in free money* from Apple’s 401(K) contributions.

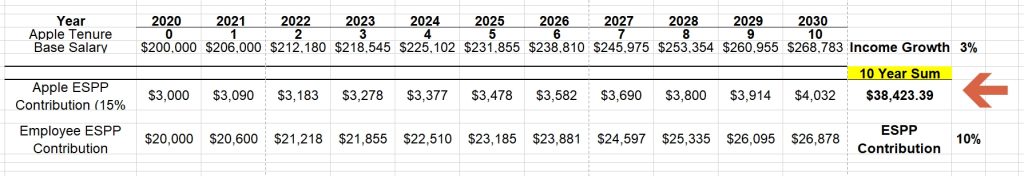

Below is another table, this time illustrating the free money* available through Apple’s ESPP.

The assumptions of the table are:

After 10 years, an Apple employee would receive $38,423.39 in free money* from Apple’s 15% ESPP discount.

Over the course of 10 years, by simply taking advantage of these two opportunities, 170,100 in additional assets are received, that the employee did NOT contribute.

In this article, we have illustrated how much free money* is attainable at Apple over a 10-year timeframe. Consider how much more is available over a 20- or 30-year career. Feel free to contact us for clarification or financial advice on your ESPP or 401(K). Please don’t hesitate to schedule a complimentary call by clicking here.

*Our use of the term “free money” is solely intended to call attention to certain financial opportunities provided to Apple employees, which are effectively access to corporate funds at no cost to the employee. In no way is our use of the term “free money” related in any way past or future investment performance.

Get to know us and how we can help. Contact our team for a risk-free, comprehensive review of your finances.

SCHEDULE A MEETING