June 12, 2024

5 Ways for Apple Employees to Avoid Owing Big on Tax

Take proactive steps to help reduce tax exposure from earned compensation. Download our comp strategies guide to help minimize year-end taxes.

Read More

In this article we will provide a structural overview of the Apple 401(k), and the options within the plan.

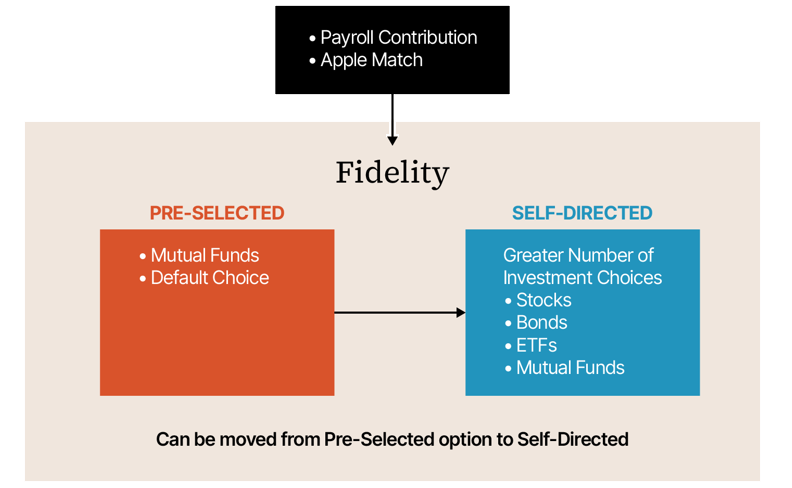

Each pay period, money is deducted from an employee’s paycheck and is re-directed into Fidelity. Apple has hired Fidelity to be the custodian and recordkeeper of the Apple 401(k) plan. Apple and Fidelity have pre-selected mutual funds for employees to choose from for the investment of their retirement savings.

Additionally, with the 401(k) plan, employees are able to transfer their funds from the pre-selected funds into a self-directed option. This is known as a BrokerageLink account within the 401(k) plan at Fidelity. Although the money is shifted from the pre-selected funds, it does not leave the Apple 401(k) umbrella. A self-directed account provides employees greater investment selection. The BrokerageLink account allows for the purchase of equities, bonds, ETFs and mutual funds, rather than only choosing amongst the pre-selected investment options.

As a Registered Investment Adviser , we use multiple custodians to invest our client’s monies. One of the custodians we work with is Fidelity. Having a custodial relationship with Fidelity gives us the ability to manage the retirement accounts for Apple employees.

While having more investment choices is advantageous, it can still be a daunting task knowing which investments to choose, how much to buy, when to rebalance, etc.

Should you want to learn more about how we can manage your Apple 401(k) please don’t hesitate to schedule a complimentary call by clicking here.

This article is provided for informational purposes only. Mariner is not affiliated with Apple or Fidelity. The plan specific information is based on sources of information deemed to be reliable, but we do not guarantee the accuracy. Please consult with you advisor prior to making any investment decisions. Investing involves risk and the potential to lose principal. 07/24

Fidelity Investments is an independent company, unaffiliated with Mariner. Fidelity Investments is a service provider to Mariner.

There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity Investments, nor is such a relationship created or implied by the information herein. Fidelity Investments has not been involved with the preparation of the content supplied by Mariner and does not guarantee, or assume any responsibility for, its content.

Fidelity Investments is a registered trademark of FMR LLC.

Fidelity Investments provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.

Get to know us and how we can help. Contact our team for a risk-free, comprehensive review of your finances.

SCHEDULE A MEETING