June 12, 2024

5 Ways for Apple Employees to Avoid Owing Big on Tax

Take proactive steps to help reduce tax exposure from earned compensation. Download our comp strategies guide to help minimize year-end taxes.

Read More

A regularly overlooked matter of financial management is life insurance. Apple provides group life insurance benefits for free up to $50,000 and the opportunity to purchase additional coverage during the annual benefit election period.

While the $50,000 free policy is a kind gesture, it is hardly enough coverage. Life insurance should be purchased to cover the loss of future income, large debts (mortgage) and major future expenditures (Ex: college). Most people should own some life insurance. However, the majority of people do not own life insurance. This is likely due to the unscrupulous nature of some insurance agents and because it can be confusing to understand. In this article, we will focus on term insurance. For additional information about other types of coverage, please read this article: An Overview of The Different Types of Life Insurance.

There are 2 types of term insurance – group and individual term. Apple allows employees to purchase group life insurance at 3x – 10x an employee’s annual salary. Purchasing a policy this way is easy and quick, but not likely the best choice for two important reasons.

The first reason group term is not ideal is a lack of portability. If an employee leaves Apple, the group term policy is difficult to transfer into an individual policy. This causes the insurance to lapse and coverage is eliminated.

The second reason is cost. If an employee is healthy, purchasing an individual policy can be cheaper than the group option. The individual term annual premiums are fixed for the term period. This is not the case with group term insurance.

Purchasing additional coverage through the benefit election process should not be done in haste. The following is an example of the diligent analysis our firm completes for our Apple clients.

Apple Employee Details:

Age – 42

Health – Excellent

Salary – $250K

Group Benefit selected through annual enrollment – 10x salary ($2.5M in life insurance).

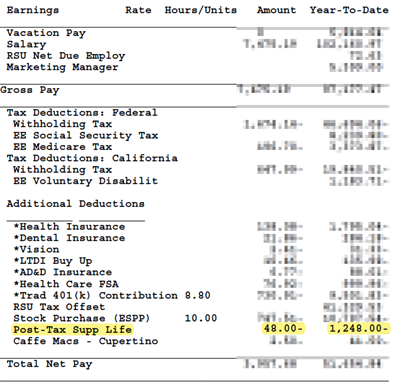

Cost per pay – $48.00 or $1,248 per year (26 x $48).

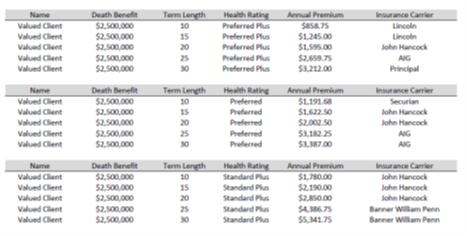

For comparison, below is a table showing the cost for an individual term policy purchased outside of Apple.

If an employee chooses the group term option through Apple, the annual premium is $1,248 per year. This insurance is not portable, and the costs can rise every year.

Per the above table, instead of purchasing a group policy, an employee can obtain an individual term policy for $858.75 per year. This is less expensive; the policy is portable, and the premiums are locked for the term period. In this example, it makes more financial sense to purchase an individual policy rather than group life insurance.

The reality, is that given the demands of life at Apple and outside of Apple, analyses such as these are too difficult and time consuming. This results in a complacent, status quo choice. Our clients hire us because they often don’t have the time or energy to analyze these things. By hiring our firm, clients leverage their time and our expertise to enhance their financial and relational well-being.

If you’d like advice on a financial matter such as this and and desire to maximize your financial relationship with Apple, you can schedule a complimentary consultation by clicking here.

Get to know us and how we can help. Contact our team for a risk-free, comprehensive review of your finances.

SCHEDULE A MEETING