If an individual has been in the Apple ESPP program long enough, they are likely to have heard the phrases “Qualifying Disposition” and “Disqualifying Disposition”.

In this article, we aim to explain what a qualifying or disqualifying disposition is and to reduce the common fear associated with receiving a disqualifying disposition notice.

First, we will explain the taxation of ESPP stock and investments in general.

Should an investment be sold 365 days or less after it has been purchased, it is subject to short-term gain/loss treatment.

Short-term gains are taxed at ordinary income rates. This is the same rate as W2 income.

If an investment is sold 366 days or more after it has been purchased, it is subject to long-term gain/loss treatment. Long-term tax rates are lower than short-term tax rates. Federal long-term tax rates are typically between 15-20%. Whereas short-term tax rates can be as high as 37%.

For most Apple employees, it is more profitable to sell an asset after it has reached long-term capital gain status.

ESPP taxation is slightly different.

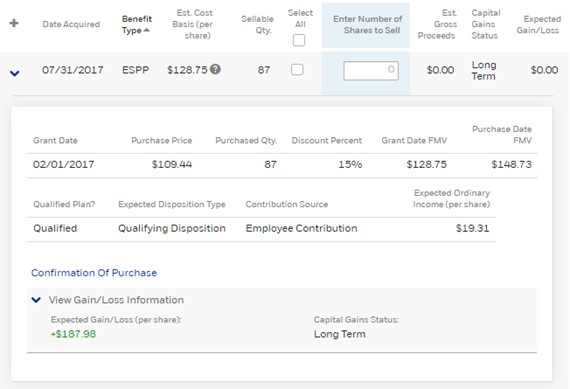

In order for an ESPP sale to qualify (keyword here) for long-term tax status, the stock needs to be sold 2 years from the date of grant and 1 year from the acquired date. A qualifying disposition means that these requirements have been satisfied. Please see the below image as an example.

When ESPP shares are sold, a portion of each sale will always be taxed at ordinary income tax rates. The portion is the 15% discount that Apple provides.

The above image is an example of a qualifying disposition. In this example, the 15% discount that Apple provides is $19.31 per share and termed “expected ordinary income.” The full $19.31 per share is taxed at ordinary income rates, also known as short-term capital gain rates.

If all 87 shares are sold at $300.00 each, the taxation would be as follows:

87 * $19.31 = $1,679.97 taxed at ordinary income rates.

- $671.98 owed for taxes (assumed 40% tax rate).

87 * ($300 – 128.75) = $14,898.75 taxed at long-term capital gain rates.

- $2,248.46 owed for taxes (assumed 15% tax rate).

Net value received if 87 shares sold at $300 = $23,179.56 ($26,100 – ($671.98 + $2,248.46).

Why Selling AAPL Via Qualified Disposition Matters

Continuing with the above example, if an ESPP is sold via a disqualifying disposition, it could cost that person 14% or more in total value.

Using the same 87 shares are sold at $300.00 each, but this time via disqualified disposition, all the gains will be taxed at ordinary income tax rates. The taxation is as follows:

87 * ($300 – $109.44) = $16,578.20 taxed at ordinary income tax rates.

- $6,631.48 owed for taxes (assumed 40% tax rate).

Net value received if 87 shares sold at $300 = $19,468.52 ($26,100 – 6,631.48).

This amounts to a difference of $3,711.04, or 14% less.

Debunking the Disqualifying Disposition

Do not worry if shares are sold via a disqualifying disposition. While it is intimidating to receive an email saying ESPP shares were sold this way, it is simply the sale of an investment at short-term capital gain rates.

Because each of our client’s financial situations is unique, we provide customized recommendations for the sale and reinvestment of ESPP shares. As a Registered Investment Advisory firm, we can custody at multiple institutions, E*TRADE being one of those. Having a custodial relationship with E*TRADE allows us to manage AAPL shares for employees in the most advantageous way. Should you have questions regarding your Apple ESPP shares, please feel free to schedule a 15-minute call here.