June 12, 2024

5 Ways for Apple Employees to Avoid Owing Big on Tax

Take proactive steps to help reduce tax exposure from earned compensation. Download our comp strategies guide to help minimize year-end taxes.

Read More

When selling Apple stock, it is very important to ensure the correct lots are sold based on your individual goals and objectives. Picking the wrong lots can cause large and unexpected taxes. We regularly advise our clients in selecting lots to sell. The subsequent instructions are an overly simplified means of how we may provide that advice.

Step 1: Log-in to E*TRADE

Step 2: Click on “Stock Plan” towards the top.

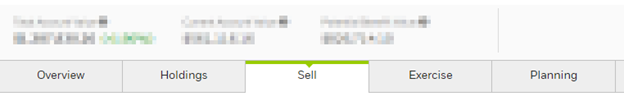

Step 3: Click on “Sell”

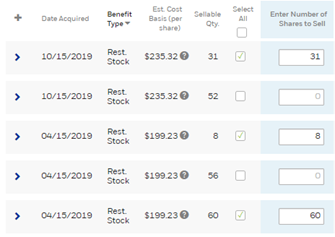

Clicking “sell” will provide a list your Apple lots and if it is from an RSU or ESPP.

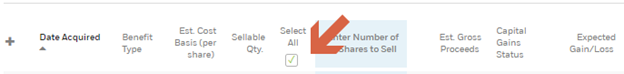

Step 4: Click on “Select All”

It is important to note, the objective is not to actually sell all the shares. By clicking this button, it populates the

“Expected Gain/Loss” column.

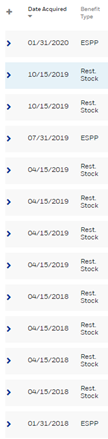

Step 5: Sort by “Date Acquired”

We typically sort by date acquired because our most common recommendation is to sell RSUs immediately upon

their vesting. An alternative sorting method we choose is to sort by “Expected Gain/Loss”.

Step 6: Once the desired lots are noted, scroll back to the top and unclick “Select All”

Step 7: Find the lots that were previously noted as advantageous to sell and start to click

those specific lots.

Step 8: Review the correct lots are chosen, scroll down to the bottom and click “Preview

Order”

Step 9: On the next screen, preview the order and then click “Place Order”

Please feel free to reach out if you have questions or would like to schedule a meeting to discuss our firm and how we can help in a similar fashion.

Get to know us and how we can help. Contact our team for a risk-free, comprehensive review of your finances.

SCHEDULE A MEETING